Improper conduct and whistleblowing guidelines

1. Summary

Introduction

These guidelines are to be read in conjunction with and provide guidance on Section 5.7: Improper Conduct of the People, Culture and Integrity Policy.

Our Framework

Section 5.7: Improper Conduct of the People, Culture and Integrity Policy and these guidelines, establish the University’s organisation-wide framework for managing Improper Conduct, consistent with the requirements of the Public Interest Disclosure Act 2012 (Vic) and, where applicable, the Corporations Act 2001 (Cth).

Our framework:

- describes governance arrangements

- aligns requirements under Victorian and Commonwealth legislation to the needs, workings and values of the University

- points to relevant individual position-holders and their responsibilities

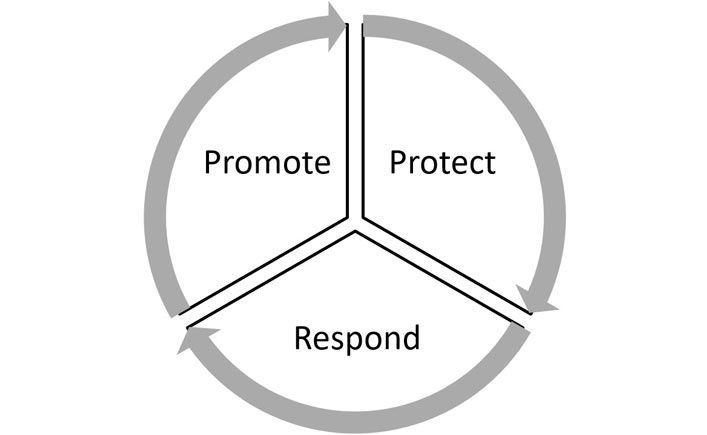

under the model of:

Promote

- PCI Policy

- Employment screening

- Staff Induction

- Awareness training

- Supplier and partner due diligence

- Implementation of the University’s conflict of interest policy

- University’s compliance program

- Publications

- Integration with Risk Management Framework

- Regular reporting

- Oversight by Senior Executive and ARC

- Audit by VAGO

- Accessible and effective framework for managing disclosures

Protect

1. Independent Disclosure Hotline Service

2. Responsible officers to protect the integrity of the framework and whistleblowers (University Secretary; Disclosure Officer; Welfare Manager / Whistleblower Protection Officer)

3. Risk management

4. Protection from detrimental action

Respond

1. Channel disclosures to appropriate officer or agency (Independent Disclosure Hotline; Disclosure Officer; IBAC)

2. Assessment and investigation procedures

3. Confidentiality and information security requirements

4. Report outcomes to VC and ARC

5. Annual audits and reports

6. Respond to and liaise with agencies as required (e.g. IBAC; Minister; VAGO; OVic)

Definitions

A definition of “Improper Conduct” is contained in Section 5.7: Improper Conduct of the People, Culture and Integrity Policy.

“Improper Conduct” includes corrupt conduct, serious professional misconduct and conduct that adversely affects the honest performance of functions. Potential examples of corruption in the University context include:

- theft

- obtaining property, a financial advantage or any other benefit by deception

- misappropriation or dishonest use of funds or assets

- providing false or misleading information about the University

- bribery, corruption or abuse of office

- unlawful use of University property including computers, vehicles, telephones

- dishonestly falsifying invoices for goods and services

- receiving or giving kickbacks or secret commissions to or from third parties

- staff making false claims for compensation such as overtime or fictitious travel claims

- credit card fraud involving unauthorised or inappropriate use of credit card

- knowingly making or using forged or falsified documents.

Serious professional misconduct is a term used in the Public Interest Disclosure Act 2012 (Vic). It may include serious breaches of a professional code or University policy. It would also cover conduct which is disclosable under the whistleblower provisions of the Corporations Act, such as offences against the Corporations Act itself.

A common example of “conduct that adversely affects the honest performance of functions” would be bribery.

Accountabilities and responsibilities

Council oversees, monitors and receives reports in respect of Improper Conduct matters through its Audit and Risk Committee, the responsibilities and procedures of which are set out in ARC’s Terms of Reference.

The Vice-Chancellor is accountable for the University’s organisation-wide approach to the prevention of Improper Conduct and the implementation of Section 5.7: Improper Conduct of the People, Culture and Integrity Policy and the internal control structures that support it.

The Vice-Chancellor, together with the senior executive, provides leadership and sets the culture that does not tolerate Improper Conduct and which supports strong internal controls.

The Vice-Chancellor is responsible for reporting to Council’s Audit & Risk Committee.

Management is responsible for:

- demonstrating a high level commitment to the prevention of Improper Conduct

- assessing the risk of Improper Conduct in accordance with Section 5.7: Improper Conduct of the People, Culture and Integrity Policy and these guidelines and consistent with the University’s risk management framework

- ensuring there are internal controls in place within their areas of responsibility for prevention and detection of any Improper Conduct in accordance with these guidelines

- promoting staff awareness

- encouraging prompt reporting of matters in accordance with these guidelines.

All staff: The Improper Conduct and Whistleblowing Guidelines apply University-wide to all staff. All staff are encouraged to report any suspected instances of Improper Conduct to the University’s Disclosure Officer or the Independent Disclosure Hotline or, if the staff member wishes to remain anonymous and make a public interest disclosure under the Public Interest Disclosure Act, to IBAC.

University Secretary

The University Secretary is responsible for:

- these Guidelines

- monitoring and reporting on the effectiveness of the University’s framework for managing disclosures and preventing Improper Conduct, comprising Section 5.7: Improper Conduct of the People, Culture and Integrity Policy and these guidelines

- providing advice on making disclosures and Improper Conduct prevention and management

- promoting awareness of the University’s framework.

The Director, Risk and Business Continuity

The Director, Risk and Business Continuity is responsible for ensuring that the University’s framework for managing disclosures and preventing Improper Conduct aligns with and is supported by the University’s broader risk management framework and activities.

Disclosure Officer

The University’s General Counsel is the Disclosure Officer.

External assistance to the Disclosure Officer

The Disclosure Officer has the ability to engage such legal, accounting or other advisers, consultants or experts as considered necessary from time-to-time in the performance of the Disclosure Officer’s duties.

Responsibilities of the Disclosure Officer

The key responsibilities of the Disclosure Officer include:

1. Receive all disclosures made under these guidelines as referred by complainants, other staff who may have received disclosures or through the Swinburne Disclosure Hotline service.

2. Conduct a risk assessment that includes:

a. If the disclosure is made anonymously or confidentially, whether the discloser’s identity may become apparent

b. Risk of detrimental action

c. Risk to others.

d. Under the procedure set out in these guidelines, conduct or commission preliminary assessments of suspected Improper Conduct to determine how the matter is to be handled, taking into account the factors considered by the Disclosure Officer to be relevant, including:

3. Is the matter really a dispute, grievance, interpersonal or some other kind of matter

4. Is the matter really about procedures or workplace practices with which the complainant does not agree rather than anything improper

5. Is the matter frivolous or trivial

6. Is the complaint vexatious

7. How old is the matter and is it still relevant and related to current staff or current circumstances at the University

8. Is it a matter that has already been dealt with in an appropriate way

9. Is it a matter for Swinburne or is it about conduct away from the University

10. Overall, is it a matter appropriate for and worthy of response under Section 5.7: Improper Conduct of the People, Culture and Integrity Policy?

a. Provide advice regarding reporting public interest disclosures to IBAC

b. When it is evident that a further investigation under these guidelines is warranted, take into account whether it is advisable to move immediately to that investigation if, for example:

11. A preliminary assessment may compromise the full investigation

12. Forensic experts are required

13. Promptness of the investigation is important.

a. Decide whether the investigation is to be undertaken internally or externally taking into account such things as:

14. The nature and seriousness of the allegations

15. The person whom the allegation is against

16. Availability and level of expertise internally to deal with the matter

17. Impartiality

18. Objectivity

19. Potential for conflict of interest.

20. Information security

21. Appoint investigator(s) if warranted

22. Appoint a Welfare Manager or Whistleblower Protection Officer where required to support the discloser and to protect them from any detrimental action, including when a matter is alerted to the University by the IBAC

23. Report to the Vice–Chancellor and other senior executives as appropriate and produce an annual fraud incident report for the Vice–Chancellor.

Welfare Manager / Whistleblower Protection Officer

1. Support the Disclosure Officer in their risk assessment

2. Informed by the risk assessment, support and protect the discloser in relation to the investigation

3. Advise the discloser of the legislative and administrative protections available

4. Listen and respond to any concerns of harassment, intimidation or victimisation in reprisal for making disclosure

5. Keep a contemporaneous record of all aspects of the case management of the discloser, including all contact and follow-up action

6. Endeavour to ensure the expectations of the discloser are realistic.

7. Report any concerns or issues to the Disclosure Officer.

8. When required, comply with guidelines published by relevant agencies such as IBAC or ASIC.

Internal Audit

The functions and responsibilities of Internal Audit are documented in the Internal Audit Charter.

Internal Audit provides assurance activities by conducting internal audits that consider governance, risk management and fraud control processes

External Audit

The external audit process provides assurances to Parliament on the stewardship of the University.

The Victorian Auditor-General’s Office (VAGO), as Parliament’s external auditor, discharges these responsibilities principally through the certification of the University’s financial statements.

External audits conducted by the Victorian Auditor-General’s Office examine fraud control processes and review disclosed matters.

2. Responding to Detected Fraud and Corruption Incidents

1. Reporting, assessment and investigation procedures

Section 5.7: Improper Conduct of the People, Culture and Integrity Policy and these guidelines set out the required reporting, assessment and investigation procedures for suspected incidents of Improper Conduct.

The Disclosure Officer may consult with the Vice-Chancellor, or in the case of conduct concerning the Vice-Chancellor, with the Chancellor, in relation to preliminary assessments to decide how to handle a matter including, if relevant, how to proceed with investigations and the appointment of investigators.

Assessments and investigations can be conducted by an individual or by a team with expertise in HR, legal and risk management matters, as determined to be appropriate by the Disclosure Officer. The Chief Financial Officer, the Vice-President (Students) or the Academic Registrar may also be involved if matters involve financial fraud or students.

The Disclosure Officer must report substantiated cases to the Vice- Chancellor and provide to the Vice-Chancellor an annual report summarising all incidents. The Vice-Chancellor must report to Audit and Risk Committee regularly, and as appropriate in respect of any material incidents.

2. Disciplinary procedures

Disciplinary procedures include:

In relation to students, the University’s regulations, policies and procedures for student misconduct

In relation to staff, include the University’s policies and procedures for staff misconduct

In relation to research, applicable University and national research codes of conduct and University policies

3. External Reporting

The Standing Ministerial Directions given pursuant to section 8 of the Financial Management Act 1994 set out notification requirements when the University is made aware of actual or suspected Significant or Systemic Fraud, Corruption or Other Loss. These must be reported to the University’s Audit and Risk Committee, the Victorian Auditor-General, the Responsible Minister and the Portfolio Department as soon as practicable.

The University must provide an initial notification and any subsequent relevant information about the incident, the outcome of any investigation and remedial action.

Significant or Systemic means an incident, or a pattern or recurrence of incidences, that a reasonable person would consider has a significant impact on the University or the State’s reputation, financial position or financial management.

The threshold above which an actual or suspected Fraud, Corruption or Other Loss is considered ‘Significant’ is $5000 in money or $50,000 in other property.

In addition, the University may involve or report matters to the Victorian Police and relevant external agencies such as IBAC and ASIC.

4. Recovery

5. Fidelity Guarantee Insurance

The University will, as part of the regular review of its insurance cover, review the appropriate level of Fidelity Insurance Cover.

6. Learning from Experience

Management should review controls for any areas affected by Improper Conduct and consider whether improvements are required.

The Governance, Legal and Integrity Unit should confirm that proportionate remedial action plans with action owners and specific dates, have been developed and documented; and record these in the Fraud and Corruption Incident Register.

Where improvements are required those improvements should be implemented as soon as practicable and communicated to other parts of the University if applicable.

7. Procedure for Reporting and Responding to Suspected Fraud or Corruption

| Procedure | Responsibility | |

|---|---|---|

| 1 | Identifying and reporting corrupt and/or fraudulent behaviour | |

| 1.1 | Assess whether the disclosure has been made in accordance with the Public Interest Disclosure Act or the Corporations Act and therefore attracts statutory protections. | Disclosure Officer |

| 1.2 | If the matter is assessed to be a disclosure under the Public Interest Disclosure Act or the Corporations Act, the person making the disclosure should be advised of relevant statutory provisions | Disclosure Officer |

| 1.3 | If the matter is assessed to be a disclosure under the Public Interest Disclosure Act, then the discloser should be referred to IBAC. If the person chooses to report the matter to IBAC, then IBAC will handle the matter or refer it out for investigation. If the elements for a public interest disclosure are not satisfied, then the matter should be dealt with under this procedure. |

|

| 1.4 | If the matter is not a public interest disclosure, report the suspected Improper Conduct to:

|

Person alleging Improper Conduct |

| 2 | When suspected fraudulent and/or corrupt behaviour is reported to line manager or other officer | |

| 2.1 | Inform the Disclosure Officer of allegation. | Manager or officer or other recipient of allegation |

| 3 | Response to reported incidents | |

| 3.1 | Record allegation on Improper Conduct Incident Register. | Disclosure Officer |

| 3.2 | Conduct risk assessment | Disclosure Officer |

| 3.3 | Conduct or commission a preliminary assessment to determine how the matter is to be handled | Disclosure Officer |

| 3.4 | Where the preliminary assessment determines that a further investigation under these guidelines is warranted, decide whether that investigation is to be conducted internally or by an external consultant, and then appoint the investigator(s). | Disclosure Officer |

| 3.5 | Ensure that the principles of natural justice are followed in any investigation. The principles of natural justice concern procedural fairness and ensure a fair decision is reached by an objective decision maker. Maintaining procedural fairness protects the rights of individuals and enhances public confidence in the process.

|

Disclosure Officer |

| 3.6 | Ensure the person who has made a disclosure is protected, has his or her needs monitored and is provided with appropriate advice and support. | Welfare Manager/Whistleblower Protection Officer |

| 3.7 | In cases where the allegation of fraud or corruption is substantiated, seek to recover any money/assets lost and seek criminal or civil restitution when it is in the best interests of the University to do so. | Vice-Chancellor/CFO |

| 4 | Recording and follow-up of instances of fraud and corruption | |

| 4.1 | 4.1 Record instances of suspected fraud and corruption on Fraud and Corruption Incident Register and include details of investigation, outcomes, and remedial action plan. | Disclosure Officer |

| 4.2 | Information security | |

| 4.3 | In cases where the allegation of fraud or corruption is substantiated, review fraud controls and consider whether improvements are required. | Director, Risk and Business Continuity and Head of organisational unit |

| 4.4 | Report to Vice-Chancellor. | Disclosure Officer |

| 4.5 | Report to Audit and Risk Committee. | Vice-Chancellor |

| 4.6 | Report externally as appropriate as per the Financial Management Act (Standing Directions of the Minister for Finance 4.3 (d)). | Vice-Chancellor / Chief Financial Officer |

Contacts

Independent Disclosure Hotline: STOPline

| Telephone | 1300 30 45 50 (for Australia) |

| Swinburne University of Technology c/o The STOPline, LOCKED BAG 8 HAWTHORN VIC AUSTRALIA 3122 |

|

| swinburne@stopline.com.au | |

| Website | www.swinburne.stoplinereport.com |

IBAC

| Telephone | 1300 735 135 (for Australia) |

| GPO Box 24234 MELBOURNE VIC AUSTRALIA 3122 |

|

| Website | http://www.ibac.vic.gov.au/ |

ASIC

| Telephone | 1300 300 630 (for Australia) |

| Senior Manager, Office of the Whistleblower GPO Box 9827 Brisbane QLD 4001 |

|

| whistleblower.policy@asic.gov.au |

Complaints to Ombudsman

Complaints about administrative actions and decisions of the University can be made to the Victorian Ombudsman.

View all policies and related resources

To find out about our other policies, regulations and resources, head to the main policies section.